Did you ever need a list of clients based on their Effective Tax Rate so that you can send them updates about the tax code? Have you ever been asked "What's my carryover from last year" and then had to dig through tax documents to determine the answer? With Tax Filings, Elements allows you to easily track high-level, historical details about your client's tax situation, and keep that information in a central location, rather than having to go through you document management systems.

As Wealth Managers, working with more complex high net worth clients, it is common to store a copy of tax filings and tracking the high level details of year over year. Tax filings will allow you a quick way to access this information without having to sift through other systems.

Hierarchy

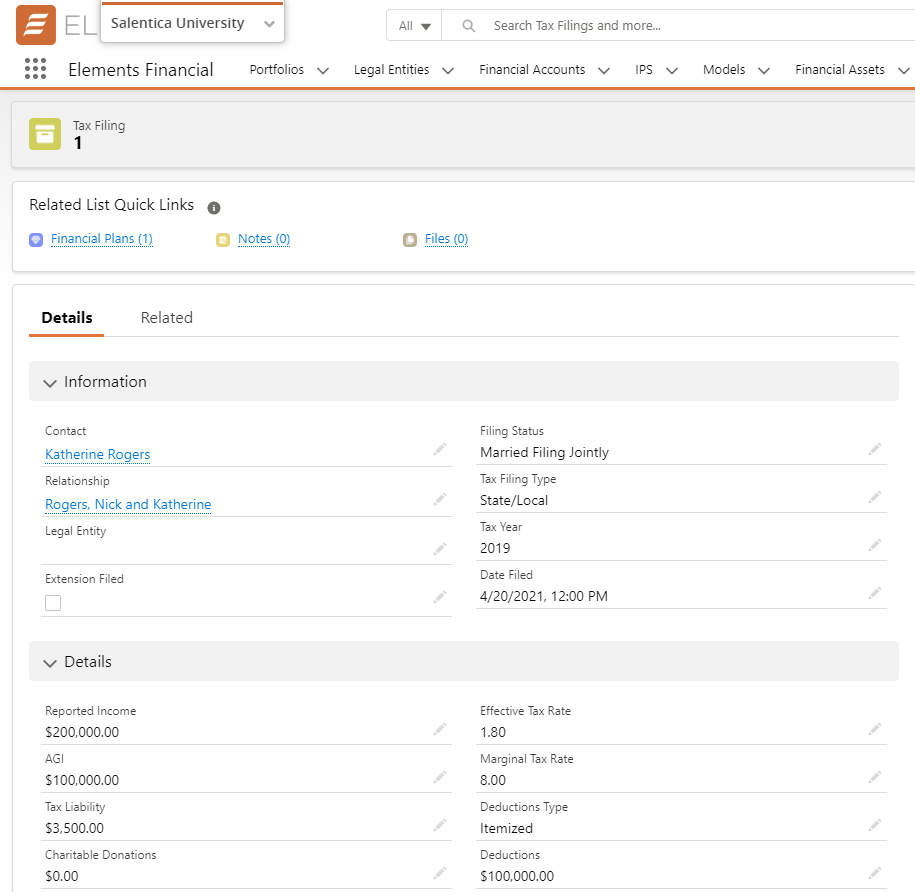

Tax Filing is located within the Elements Financial App, and can also be found on the Contact, Relationship, and Legal Entities. Tax Filing can be linked to Relationships, Contacts and/or Legal Entities.

What's included in Tax Filing

Information

- Contact

- Relationship

- Legal Entity

- CPA/Accountant

- Extension Filed

- Filing Status

- Tax Filing Type

- Tax Year

- Date Filed

Details:

- Reported Income

- AGI

- Tax Liability

- Charitable Donations

- Charitable Contributions Carry Over

- Prepaid Taxes

- Credits

- Effective Tax Rate

- Marginal Tax Rate

- Deductions Type

- Deductions

- Loss Carry Over

- Gifting

- Safe Harbor